Why a Makino isn’t enough

Stop competing on price! Learn how to combat commoditization — exemplified by the Makino’s effect on the manufacturing industry.

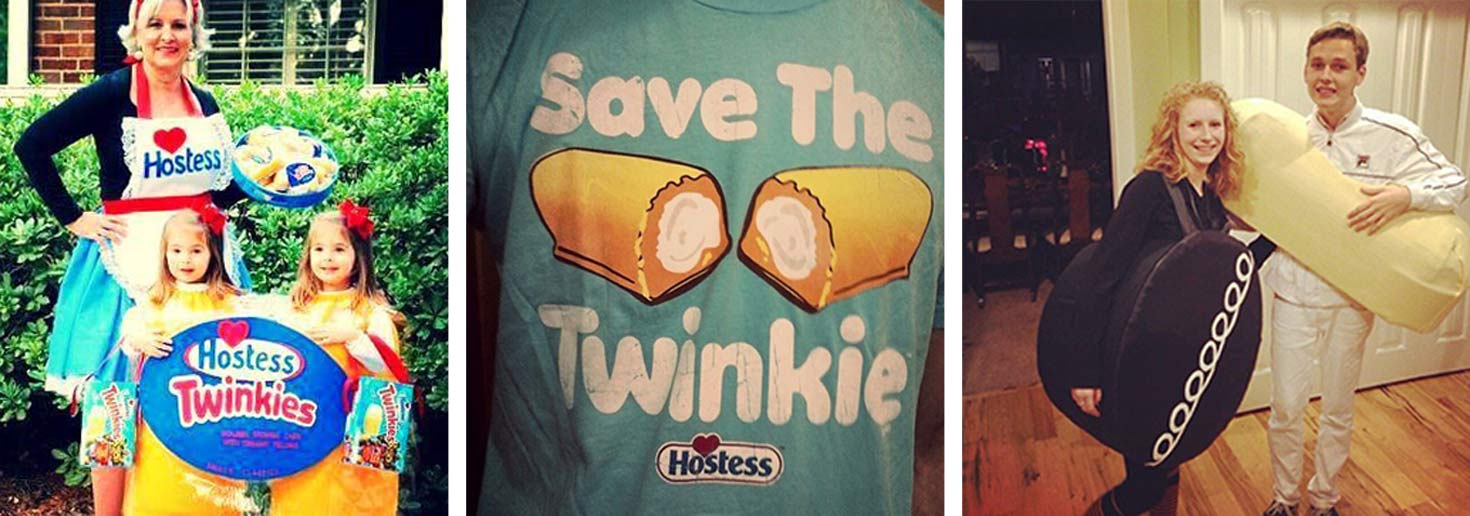

In November of 2012, popular snack brand Hostess officially announced that it was going out of business. The company had failed to climb out from under a mountain of debt, with a nationwide workers’ strike and sales down almost 20% (assumed to be the result of consumers opting for healthier foods). Bakery operations were suspended at all plants – ending all Twinkie production in the United States.

You may remember this famous moment in pastry history (or, “pastory,” if I may). If so, you probably know what happened next:

Twinkie fans went a little crazy.

This news was met with outrage, disappointment, and (frankly) hysteria. The nostalgia of the heart-clogging snack must have gotten the best of many, because people began stocking up to prepare for Twinkie-pocalypse. Fans stormed supermarkets to buy them by the armful, and a wildly inflated “black market” of Hostess products reared its costly head on eBay – with one seller auctioning off a full box of Twinkies at a starting price of $200k.

Most execs would pay good money for that kind of brand loyalty – and in fact, they did. Within weeks, the Twinkie brand (along with other famed Hostess brands) were purchased out of bankruptcy by Apollo Global Management. What Apollo knew was that Hostess' value wasn't in the P&L but rather in their marketing, positioning, and brand loyalty. Moving quickly, Apollo had Twinkies back on shelves the following summer. And, just 4 years later, Apollo's investors saw the sweetest of returns: a $2.3 billion sale on their $410 million investment.

While small businesses rarely have brand fanatics like Twinkie, when it comes to ownership transitions all are looking for the same thing: a way to maximize value for the long-term, and create a space where competitors struggle to measure up.

At Kinesis, we often work with businesses undergoing an ownership transition. They tend to fall into several different categories:

If you talk to most business brokers, they’ll tell you that in any of these cases you should be (or be seeking) what’s called a “strategic buyer” over a “financial buyer.” Financial buyers are investors typically only interested in a company’s revenue and book of business – while strategic buyers are interested in a company’s fit into their own long-term business plans.

Jennifer Fern, VP and Senior SBA Specialist at KeyBank, has helped a number of businesses with this type of transition. She had this to say:

“Companies can increase their business sales price and/or attractiveness to a strategic buyer by having the foresight to invest in a marketing/branding campaign three to five years before putting their businesses on the market.”

- Jennifer Fern, VP and SBA Specialist at Keybank

When Kinesis works with our clients on these types of transitions, our approach is to maximize the value of the business. We do this by thinking through strategy – which positions them better against their competition, allows them to command a higher price point, and generate greater margins. This way when it comes to sale, the business is positioned as a strategic operator — not just a “me too” or one of many in the marketplace.

One way we do this is by focusing on the company’s larger business strategy. If you’re purchasing a business or looking to get purchased, your business strategy will be paramount to determining the long-term value of the company. If the following strategic measures aren’t in place, they can amount to valuation discounts – wherein unfavorable attributes literally detract from the value of the business. Considerations should include:

Another major consideration when valuing a company is marketing maturity – and what data, tools, and experience will contribute to the long-term success of the business.

“Brand recognition and customer loyalty add to the intrinsic value of a company. They drive sales, insulate a company from competition, and lead to increased market share.”

- Jennifer Fern, VP and SBA Specialist at Keybank

As the Twinkie story showed us, the value of a company’s established brand also plays a huge role in valuation – but measuring brand value can be both an art and a science.

One approach is to determine how much more money a customer is willing to pay for your product or service against a comparable alternative. As one news reporter pointed out back in 2012, consumers never lost the option of off-brand Twinkies.

We make these types of decisions at the grocery store every day: Do you buy store brand cereal, or spring for Cheerios? Would the generic drugstore Ibuprofen do the trick, or do you opt for the more-expensive Advil?

Of course, this is only one piece of a much larger puzzle. Determining the exact value of a brand requires measuring countless intangibles – like the steadfast devotion that Apple fans show when the company makes its products incompatible with others, or that Coca-Cola loyalists do when they opt for a different beverage altogether rather than accept Pepsi instead.

These types of brand equity discussions can lead to multi-billion-dollar decisions, like when Amazon bought Whole Foods last year for $14 billion. To quote Forbes, “You can bet that a company with the same financial statements and weaker brand loyalty would have made a far smaller dent in Amazon’s checkbook.”

This only begins to scratch the surface of how marketing can contribute to mergers, acquisitions, and succession planning. Marketing also helps HR attract top talent, salespeople close deals, and customer service create engaged client communities via tools like social media. So, whether you're a buyer or a seller - marketing is one of the primary considerations when it comes to company valuation.

Many of these measures are qualitative, of course, but as one sugary snack has taught us, one thing is for sure: Having loyal fans who won’t even let you leave the market when you hit hard times? That’s priceless.

Thinking about selling your business in the next 2–3 years and want to get ahead of marketing valuation? Looking to acquire a new company and need help evaluating marketing strength as part of your negotiations? Or, have you just bought a business without these marketing components and are hoping to maximize the value of your purchase? Kinesis can support you wherever you are in your business transition — give us a call today.

Get insights like this straight to your inbox.